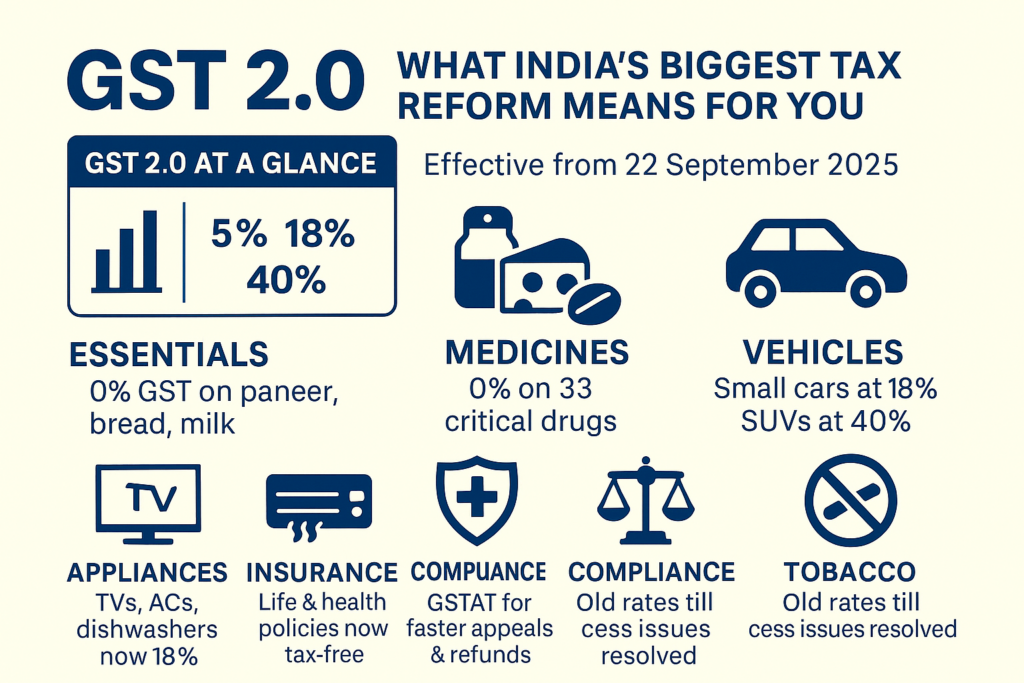

The Government of India has announced a sweeping overhaul of the Goods and Services Tax (GST), marking the most significant reform since 2017. Branded as GST 2.0, the changes are designed to simplify the tax system, reduce the burden on essential goods and services, and promote compliance through transparency and efficiency. These reforms will be effective from 22 September 2025.

Key Highlights of GST 2.0

1. Simplified Tax Slabs

- 5% for essentials.

- 18% for most goods and services.

- 40% for luxury and sin goods (like high-end cars, SUVs, and certain harmful products).

This three-tier system replaces the earlier 5%, 12%, 18%, and 28% structure, making GST easier to understand and implement.

2. Essentials Get Cheaper

✅ 0% GST on:

- Life & health insurance

- Paneer, bread, UHT milk

- Stationery & maps

✅ Lower GST on:

- ACs, dishwashers, TVs → 18% (down from 28%)

- Small cars & bikes (≤350 cc) → 18%

- Life-saving medicines → 0% on 33 critical drugs; 5% on others

Impact: A clear boost for households, students, and patients. Families will save on daily consumption, education, and healthcare expenses.

3. Luxury Gets Costlier

- Larger vehicles, premium SUVs, and high-end goods now taxed at 40%.

- This reflects the principle of “ability to pay”—keeping essentials affordable while taxing discretionary spending higher.

4. Gradual Rollout for Tobacco & Pan Masala

- Old rates continue until pending cess obligations are settled.

- A phased approach avoids disruption in this sensitive sector.

5. Faster Dispute Resolution

- Goods and Services Tax Appellate Tribunal (GSTAT) to begin operations by end-September 2025.

- Appeals backlog deadline: 30 June 2026.

- Refunds under inverted duty structure to be automated, reducing compliance delays.

Economic Outlook

- Revenue impact: Govt estimates a loss of ~₹48,000 crore.

- Growth driver: Lower taxes on essentials expected to fuel consumption.

- Market response: Auto and consumer goods stocks surged post-announcement.

What This Means for You

- Households: Lower monthly expenses on food, healthcare, and appliances.

- Students: Stationery and maps become tax-free.

- Policyholders: Insurance becomes more affordable.

- Consumers: Big-ticket discretionary items like SUVs and luxury goods will cost more.

Conclusion

GST 2.0 is more than just a rate adjustment—it represents a strategic shift towards simplicity, fairness, and inclusivity. While businesses must update systems and pricing strategies, consumers will see immediate relief on essentials and a push towards transparent taxation.

From 22 September 2025, India enters a new chapter in indirect taxation—one that balances growth with equity.